While COVID-19 infections and deaths are surging in many parts of the country, prompting officials in some places to weigh reinstituting lockdowns, the Rochester region has sharply reduced both cases and deaths.

But though the coronavirus risk level in this region seemingly is low and under control, the same might not be true for the local economy. In fact, there are several reasons why the economic recovery here could stall in the coming weeks and months—if it hasn’t already.

To be sure, the regional economy has moved smoothly through New York’s reopening phrases and rebounded from the lockdown-induced contraction. Yet it remains a long way from a full return to normal.

■ The latest Bureau of Labor Statistics data show that in June the number of employed people in metropolitan Rochester was down nearly 43,000—or approximately 9 percent—compared with January. The ranks of the unemployed were up by 34,000, despite a rebound of 16,500 since April. June’s unemployment rate was 11.3 percent, down from 14.9 percent in April but up slightly from 11 percent in May—and dramatically higher than an average of 4.6 percent in the three months before the pandemic arrived locally.

Jobless rate in metropolitan Rochester

■ Initial claims for unemployment benefits remain at historically high levels. The weekly total peaked at 25,037 in the seven-day period ended Mar. 28, then generally declined over the next two months. Since the end of May, however, the weekly total has plateaued at an average of roughly 5,000, a number that is 400 to 500 percent above year-ago levels; only in the most recent week, ended Aug. 8, did the number drop below 3,000. From March 14 to Aug. 8, 177,312 initial claims were filed versus 20,230 in the same period of 2019—an increase of 157,082.

■ Many area businesses—including some of the region’s top employers—face daunting challenges as they struggle to regain their footing. Medical center officials at the University of Rochester, the area’s No. 1 employer, in May projected a half-billion-dollar hit to their budget; URMC furloughed nearly 20 percent of its staff of 17,885.

Xerox and Eastman Kodak—two of Rochester’s traditional Big Three employers—in the last few weeks reported second-quarter results with big declines in revenues. Xerox’s top line fell 35 percent, and Kodak’s revenues dropped 31 percent. While Kodak was buoyed late last month by the announcement that it had reached a deal for a $765 million loan from the U.S. International Development Finance Corp. to set up a new division, Kodak Pharmaceuticals, that would add 300 or more local jobs, the uplift was brief: Within days, word came that the Securities and Exchange Commission was looking at possible insider trading prior to the announcement, and the DFC tweeted on Aug. 7 that “recent allegations of wrongdoing raise serious concerns. We will not proceed any further unless these allegations are cleared.”

Good government policy, a top-notch local health system and a high level of public compliance with precautionary measures have clearly made a difference here in the fight against COVID-19.

But unlike the local infection rate, Rochester’s economy is vulnerable to numerous factors beyond the region’s control. Among these are federal government policy, failure in other parts of the country to prevent a summer surge, and consumers wary of returning to spending at pre-COVID levels.

Washington’s response

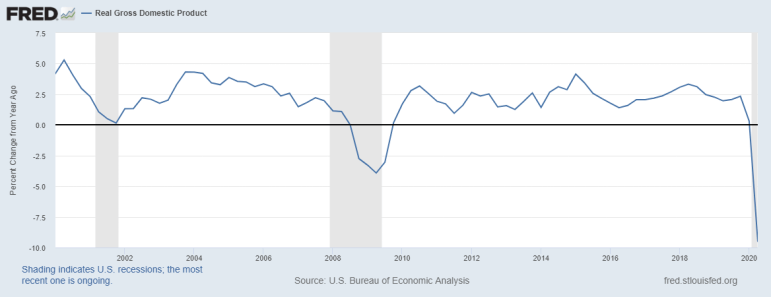

Real gross domestic product nationwide in the second quarter fell by nearly 10 percent—a stunning drop without precedent in recent history. Since mid-March, the U.S. Census Bureau Household Pulse Survey shows, half of all Americans have suffered a loss of employment income. Yet the pandemic-induced damage to the economy would have been much worse without the financial lifeline that the CARES Act provided to both families and businesses.

Percentage change in real GDP

A preliminary study by researchers at the Massachusetts Institute of Technology and the Federal Reserve estimates the Paycheck Protection Program, a key part of the stimulus passed by Congress after the country went into lockdown, saved 1.4 million to 3.2 million jobs. But small businesses seeking relief now are out of luck; the program ended Aug. 8. In the Rochester area, more than 7,500 businesses received PPP loans—some worth millions of dollars.

Gone, too, is the weekly $600 supplemental pandemic unemployment benefit that kept many families afloat in recent months. Negotiations in Congress to extend the extra benefit have run aground, and President Donald Trump’s attempt to bypass Capitol Hill with executive orders that would, in part, extend bonus payments until December appears stymied due to questions about presidential authority and states’ willingness to help fund and carry out the program.

A New York Times analysis of the $600 weekly extra benefit shows how failure to renew it could have a highly negative impact on the economy—and, in particular, hurt low-income families. Times columnist Paul Krugman, a Nobel Prize-winning economist, wrote last month that without an extension “we’re (likely) heading for weeks if not months of extreme financial distress for millions of Americans, distress that will hobble the economy as a whole.”

In a more recent column, he wrote that “evidence on the initial effects of emergency aid suggests that the end of benefits will push overall consumer spending—the main driver of the economy—down by more than 4 percent. Furthermore, evidence from austerity policies a decade ago suggests a substantial ‘multiplier’ effect, as spending cuts lead to falling incomes, leading to further spending cuts. … (W)e seem to be headed for a Greater Recession—a worse slump than 2007-2009, overlaid on the coronavirus slump.”

The end of the PPP could be an additional big blow to the economy. A survey by the National Federation of Independent Business found that roughly 20 percent of small-business owners believe they might need to lay off workers after exhausting their PPP loan. Nearly half think they will need more financial support in the next 12 months.

A Cornell University survey conducted July 23 to Aug. 1 produced a similar finding: It showed that of workers who were placed back on payrolls after being initially laid off or furloughed as a result of the COVID-19 pandemic, “31 percent report that they have been laid off a second time, and another 26 percent of those placed back on payrolls report being told by their employer that they may be laid off again.”

Equally striking is the fact “more respondents reporting that they were laid off or furloughed twice (reside) in ‘healthy’ states,” versus states now experiencing a surge in COVID cases. The researchers concluded that the key factors likely were the general state of the economy and “the exhaustion of the PPP funds by businesses that had used such loans to place their former employees back on payroll, whether or not they had work for them.” Putting workers back on payroll was a condition for forgiveness of the PPP loan advances, which in aggregate totaled $521 billion.

‘A pandemic depression’

The fact that a second wave of layoffs and furloughs is more evident in states with better COVID numbers could have a simple explanation: Just as spikes in deaths lag surging infection rates, the heavier economic toll could be yet to come for states that resisted strict lockdown rules.

Here’s another way in which the economy resembles the virus: It knows no borders. Many Rochester businesses have customers around the country; they are vulnerable to conditions elsewhere that weaken demand for their products and services.

Krugman is not alone in his grim assessment of the economy’s prospects, especially if Washington fails to enact another round of financial support for families and businesses. Economists Carmen Reinhart and Vincent Reinhart write that the “situation is so dire that it deserves to be called a ‘depression’ — a pandemic depression.” And though his phrasing is more cautious, Federal Reserve chairman Jerome Powell has acknowledged the surge in COVID cases is weighing on the economy.

Narayana Kocherlakota, the Lionel W. McKenzie Professor of Economics at the University of Rochester and a former president of the Federal Reserve Bank of Minneapolis, said in a recent Q&A posted on the UR website that the virus and the economy are intertwined: How the economy fares will depend on how effectively we combat COVID-19.

“In the worst-case scenario, governments are unable to get on top of the disease, resulting in wave after wave of new cases. Then we’d be stuck at near 10 percent unemployment for a very long time,” he said.

“If the virus remains a threat, then stimulus will be critical,” Kocherlakota added. “If people are not working, we need the government to provide money for them to continue making purchases. Without those stimulus payments, demand will falter and unemployment will stay high. … Given the political dialogue and my assessment of national public health policy, I really worry about what the economy will look like in the fall.”

The confidence factor

If most states can avoid another round of lockdowns, will the prospects for the economy brighten considerably? Not necessarily. Consumer spending is the No. 1 driver of economic activity, accounting for nearly 70 percent of GDP, and the evidence so far suggests that many people will hold back on spending even if reopenings remain in place. The Congressional Budget Office forecasts through the end of next year, U.S. consumers will buy roughly $300 billion to $370 billion less than projected had the pandemic had never happened.

In April, a National Bureau of Economic Research working paper co-authored by Lisa Kahn, a University of Rochester economics professor, outlined evidence that stay-at-home orders were not solely responsible for economic contraction during the COVID-19 pandemic, and thus lifting these orders would not trigger a swift recovery. Restoring consumer confidence will a big factor in reviving the economy, she believes.

A working paper published in June by University of Chicago economists Austan Goolsbee, chairman of the Council of Economic Advisers in the Obama administration, and Chad Syverson reached the same conclusion. Their research suggests that legal shutdown orders accounted “for only a modest share of the massive changes to consumer behavior. … While overall consumer traffic (in the regions they studied) fell by 60 percentage points, legal restrictions explain only 7 percentage points of this.”

As states reopened nationwide in May and June, consumer confidence rebounded. But when COVID infections and then deaths began to climb again, consumers’ outlook turned darker. In July, the Conference Board Consumer Confidence Index decreased, falling to 92.6, down from 98.3 in June.

The latest New York State Index of Consumer Sentiment from the Siena College Research Institute tells a similar story—even though New York in recent months has done better than most states in controlling the virus. Consumer sentiment statewide in the second quarter was both below the breakeven point at which optimism and pessimism balance, and down 22 points from the end of 2019.

New Yorkers believe “they are personally worse off and that the year ahead will be a rocky one for New York State,” observes Doug Lonnstrom, professor of statistics and finance at Siena College and SCRI founding director.

The months ahead

Two additional challenges for the Rochester region’s economy could be on the near horizon. One is students’ return to the classroom. At all levels, from elementary school to college, many local students will be attending at least some classes in person. Any epidemiologist—not to mention common sense—will tell you this ups the odds of a spike in COVID infections here. A big increase could put us back where we were in March and trigger a return of stay-at-home orders.

The other looming challenge is the pandemic’s impact on state and local government budgets. New York has estimated its tax revenues will fall by $13 billion in 2021 and by $16 billion in 2022. Budget shortfalls in Albany translate to reduced funding at the local level, where governments face revenue gaps of their own. Monroe County’s sales tax collections were off roughly 30 percent at the peak of the lockdown and still were down nearly 14 percent year-over-year in July. And the New York Times reports that the city of Rochester is particularly vulnerable due to its high degree of dependence on state aid. The months ahead could bring significant cuts in local government employment.

What we can do

If the greatest threats to the local economy are factors beyond our control, what can we do to limit the risk?

To me, it’s important how businesses respond to the difficulties they face. It’s clear that many are struggling like never before. But just as clearly, keeping workers on the payroll helps to steady the economy. For the community’s sake, they should try to take the long view; additional furloughs may be necessary, but layoffs should be a last resort.

Companies also should continue to allow employees to work remotely if they can. As I wrote in May, the economic numbers in the spring would have been even more grim if not for the fact that many businesses swiftly and effectively made the shift to operating remotely when COVID struck. A number of firms were surprised to discover that employees were as productive—or even more so—when working from home. And, of course, their chances of becoming infected is sharply reduced.

Finally, we all must continue to take COVID seriously. The decline in daily numbers and our ability to move around more freely in summer have brought a semblance of normality. But the virus has not gone away. Until we have a safe, effective and widely available vaccine, COVID will continue to shape our lives.

The Rochester economy is not immune to that fact. We should be heartened by signs of progress but never forget that, as Carmen and Vincent Reinhart put it, the nascent economic recovery “is the beginning of a long journey out of a deep hole.”

Paul Ericson is Rochester Beacon executive editor. All coronavirus articles are collected here.

Please update this article and republish it. It is even more valid today in November as it was in August. Especially with the 2nd illegal lockdown taking place that will put the finishing touches on destroying the Rochester and sounding economies.

Not to mention that the NYS economy wasn’t that robust before the the pandemic. Per the census there was a constant brain and money drain of residents to other states. Mr. Krugman is a ideologue who has been wrong much of the time (his advise in 2016 was that a Republican win would crash the economy and the markets, I hope nobody here took his advice and sold their stock in 2016 because that move would of been a looser) . Unfortunately the Gov’s plan here (when he is not accepting Emmy Awards and writing self aggrandizing books) is to lobby for a Federal Bailout for his failed economic state and have Federal tax payers pay for his bloated bureaucracy along with its endless demand for taxpayer funded pensions and healthcare for state workers.

We need to get to the root of the cause which is, to hold all our NY Senate and Assembly representatives and other officials like the health Dept, etc. accountable. “It is imperative that the State Legislature returns to Albany now to repeal Governor Cuomo’s extended powers that gave him the ability to impose crippling restrictions on New Yorkers”…These tyrannical, draconian edicts that violate and trample on the rights of individuals, businesses, families, friends, and religion. are completely illegal.

Please explain to your NY State Assembly and NY State Senate that they are all accessories to these violations of our US Constitutional rights.

Substantively, no government entity in America has the lawful power to curtail natural rights like our First Amendment freedom to gather, conduct business, freedom of religion, etc. taken, by decree.

When the federal judge rules in favor of “We the Citizens of NY”, Will sue the individual official, the agency that the official works for, the city, county, or state level representatives that allowed this to occur, to the maximum amount possible by law. Please review:

( 1.) TITLE 18, U.S.C., SECTION 242

( 2.) TITLE 42, U.S.C., SECTION 1983

We all need to write, e-mail, and phone all these accessories to the violations of our US Constitutional rights!

Amen, there needs to be push-back against these people. The constitution doesn’t dissolve in a pandemic. This is one of the consequences of 1 party rule in Albany.

Here’s a suggestion. Baby Boomers are mostly retired and dependent on Social Security. Many are in a high-risk category and rely on home delivery of as many things (food, medicine, take out meals) as possible. Rather than reduce or defund Social Security, give seniors a permanent boost in their monthly payments. They in turn will put more money into the local economy to purchase necessities and services, maintenance, and repairs. More funding and incentives should be provided by health insurance companies and Medicare to promote telemedicine, and maybe even home health visits to help URMC and other providers boost revenue. Policymakers in Washington, Albany, and locally need to think outside the box about how to shift citizens’ purchasing habits and provide incentives to change. One last thing, if students are going to learn from home for at least the next 10 weeks, the county could provide screening, training, and financial incentive for out of work residents to help beleaguered parents with in-home childcare and tutoring.