Authoritative summaries of “The Economic Impact of COVID-19” won’t be publishable for years to come. Perhaps you’ll settle for a few observations.

Globalization in decline? Can we gain from reshoring?

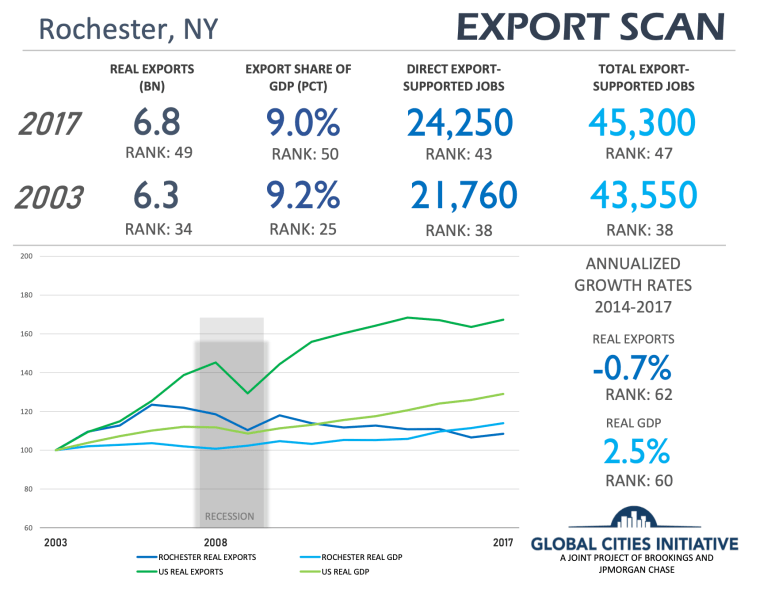

Rochester long held a strong position in export markets—it ranked in the top five U.S. metros by some metrics in the early 1990s. Our standing has slowly dissipated as Kodak and other leading exporters have shrunk. The latest Brookings Metro Monitor report ranks Rochester’s export intensity, measured as share of export-supported jobs, at 47, very close to our population rank of 52.

Perhaps there is lemonade to be made as the tide turns against globalization. We retain significant manufacturing capacity and knowledge of global trade. Let’s take advantage of the “reshoring” imperative thrust upon us by COVID-19.

That was the logic behind Kodak’s planned expansion into pharmaceuticals under the Defense Production Act, although the deal remains on hold as charges of insider trading are investigated. Even if the Kodak deal is ultimately scuttled, it may serve as an example of the value Rochester’s industrial capacity offers the nation as we seek to reduce our dependence on foreign markets for key products.

Debt? What debt?

Rich countries’ ability to borrow seems limitless. During 2020 they’ve kept the economy afloat by borrowing $4.2 trillion to finance tax cuts and subsidies. Much of the new debt has been purchased by central banks. New reserves created to buy all of this debt totaled $3.7 trillion. FYI, that’s what economists mean by “printing money.” The physical printing of greenbacks is quite beside the point. Cash? What cash?

The U.S. Federal Reserve also has been buying up corporate debt like crazy. No one wants business to slow just because it can’t borrow a few bucks. Eleven percent of U.S. corporate debt is now held by the Fed and the Treasury.

Stubbornly low inflation (which is a longer conversation) makes it possible to “print money” without driving up interest rates. The traditional curb on government spending was what we called the “crowding out effect”—that government spending would drive up interest rates and limit private-sector growth. But that connection between inflation and economic activity (the simplistic version captured by the “Phillips Curve”) seems to have been broken, at least temporarily.

The notion that government deficit spending can be freely financed by money creation is one practical conclusion of Modern Monetary Theory. Suspicious of the rest of the MMT trappings, I will concede that economic gravity does seem to have been temporarily repealed, at least for the United States.

On a related note, the benefits of issuing the world’s reserve currency can’t be overstated—our retreat from global agreements and from our traditional role as a stabilizing influence on world affairs puts this at risk. The dollar remains king—the International Monetary Fund reported that 62 percent of the world central bank reserves were denominated in dollars in the second quarter. Although neither the euro nor the yuan pose an immediate challenge, we shouldn’t take the dollar’s hegemony for granted.

I’m channeling an exploration of these data and issues in the July 25 edition of The Economist.

Who said that capitalism and totalitarianism don’t mix?

I was one of many who piously asserted that totalitarian government and capitalism couldn’t long co-exist. Russia’s path is explainable as it replaced crony communism with crony capitalism, not free markets.

China is another story—it is now the world’s largest economy in the world, if the currency is adjusted for purchasing power. Under Xi Jinping, China is taking advantage of central control to deepen and broaden its economy. It is no accident that China’s exports reached its second-highest level in history in the second quarter. The coronavirus lockdown in China was serious business—and now their economy is back while the U.S. suffers from a dysfunctional mix of political division and federalism.

Nor can we still claim that China only imitates our science and technology. Their imitation of our Global Positioning System is an improvement. The just-completed BeiDou system of 35 satellites offers 10 cm accuracy in the Asia-Pacific region v. the 30 cm GPS accuracy.

More ominously, China is using its crackdown on the Uighurs in Xinjiang province to further its lead in surveillance technology. Artificial intelligence learns by doing—and Chinese AI systems are practicing on 12 million Uighur faces in Xinjiang.

The reckoning for higher education has arrived

China prosperity has been good for American universities, including many in Rochester, with an estimated 360,000 studying in the U.S. pre-COVID and spending $14 billion. Between travel restrictions due to the pandemic and changes in federal policy, the number of international students is likely to fall. Post-secondary institutions that have become dependent on the Chinese may face a reckoning.

The lightning-speed shift to online has also accelerated discontent over university tuition and fees. While the residential college experience will rebound with a tamed COVID, the crisis shows that it isn’t the only viable model. Purdue University foreshadowed the trend by purchasing Kaplan University in 2018 and forming the all-online Purdue Global. While the 2019 division still lost money in its first full year, the new venture brought in 15 percent of the university’s total revenue and positioned Purdue to improve its market position during the coronavirus.

The University of Arizona and University of Massachusetts have followed suit with just-announced acquisitions of Ashford and Brandman universities, both for-profit, online institutions. Canny Mitch Daniels, Purdue president, has also challenged the status quo by keeping tuition flat for nine years. Having previously served as head of the White House Office of Management and Budget, he knows how to cut costs.

Higher education is now Rochester’s largest industry. Some shakeout is in store—let’s do what we can to help our schools survive and thrive in what promises to be a hypercompetitive higher ed economy.

Kent Gardner is Rochester Beacon opinion editor. All coronavirus articles are collected here.