Disaster is custom-made for screenplays. A graphic novel about climate change became the inspiration for Bong Joon Ho’s 2013 move, “Snowpiercer” (and a series now running on TNT). If Bong is not familiar to you, his “Parasite” won Best Picture winner at last year’s Oscars.

The setup for “Snowpiercer” is an effort to reverse global warming through geoengineering. As we should have learned from reading Greek tragedy in high school (if only), we pay a price for our hubris. The tech works VERY well and a new Ice Age threatens extinction.

Humility before the climate gods demands that we do the hard work of reducing greenhouse-gas emissions, although gloomy trends on the pace of GHG reduction suggest that geoengineering R&D should stay on the table.

Because that’s where the money is

GHG emissions come from a broad cross-section of activities and geographies. China tops the global list of sources with the United States firmly in second place. The Biden administration has made climate change a top priority and seeks approval for massive spending plan. The debate will be about strategy and scale.

Regular Beacon readers may recall that the belch of a cow contains methane, a potent GHG. Our nation’s 9.4 million dairy cows contribute 1.3 percent of the U.S. contribution of GHGs. Add in beef cattle and the bovine share of GHGs more than doubles. That’s a lot of belches to manage to cut GHG by only 3 percent. What are our other options?

Disclaimer: Measuring GHG sources and connecting these sources to uses is complex. Better-informed readers are invited to correct errors of omission and commission in the comments. The goal of this story is to provide readers with a context for the Rochester Beacon’s April 21 virtual event on three renewable sources of power: solar, wind and hydrogen fuel cell.

The “lowest-hanging fruit” in GHG reduction remains coal-fired power plants, which generate only 28 percent of the power while creating two-thirds of the total GHG emissions. There are 252 operating coal-fired power stations in the U.S. (and none remaining in New York). That’s an easier target than the cows. Production capacity from coal currently is about 234 gigawatts, a reduction of 126 GW since 2000, largely replaced by units burning cheaper and cleaner natural gas.

Globally, coal-fired generation is significantly greater in China with 1,082 power stations operating with a capacity of 1,042 GW, half of the world’s total capacity, and another 82 GW of capacity under construction. India operates plants with 229 GW of capacity and 37 GW under construction. The U.S. can get involved through global agreements, plus by investing in research on carbon sequestration and “clean coal” combustion.

On the road again

Looking at the log in our own eye, however, road transportation accounts for about a quarter of U.S. GHG emissions, with cars and light trucks contributing 71 percent of that total. Medium- and heavy-duty trucks contribute another 28 percent. While 252 coal-fired power stations are an easier target (unless you’re West Virginia’s Democratic Sen. Joe Manchin), mobile transport contributes 60 percent more GHG emissions.

Electric mobility is hot, even if Tesla’s stock price whiffs of irrational exuberance. And for good reason: A year-old software update to the company’s “computer on wheels” cut the 0-60 time on the Model S to a yet-more-ludicrous 2.3 seconds, which is close to the descent velocity of the Formula Rossa roller coaster in Abu Dhabi’s Ferrari World theme park.

Cars propelled by electric motors don’t spew GHG by burning fossil fuels like gasoline and diesel, but the electricity has to come from somewhere. In most electric vehicles, the power comes from batteries. The batteries are charged from the power grid, owned and supplied by power utilities. The utilities get their power from large generating plants.

If these plants burn coal, we may not have made any progress on reducing GHG.

New York state of mind

New York’s 2015 Energy Plan set a goal of reducing GHG emissions by 40 percent from 1990 levels by 2030 and 80 percent by 2050. Half of New York’s power was to come from renewable sources by 2030. The 2019 Climate Leadership and Community Protection Act made the state’s energy plan much more aggressive, increasing the 2030 renewable share to 70 percent, the 2050 GHG reduction to 85 percent and setting a 100 percent “carbon free” generation goal for 2040.

The new plan is prescriptive in the sources of power it seeks, including:

■ 9,000 MW of offshore wind by 2025

■ 3,000 MW of energy storage by 2030

■ 6,000 MW of distributed solar by 2025

The plan also calls for 185 trillion BTU in energy savings through efficiency programs by 2025 (from a 2015 baseline).

The CLCPA also sets targets for the distributional effects of the plan, requiring that 35 percent of the benefits from clean energy investments flow to disadvantaged communities.

Like the rest of the plan, the targets for wind and solar are quite ambitious, which we explore below. Plug Power’s announced expansion plans in Rochester put hydrogen back on the front page, thus is also discussed.

RECs Rex

The principal mechanism for achieving specific generation targets is the renewable energy certificate, or REC. A REC is designed to bridge the gap between the quantity of a desired form of generation being offered at market prices and the target quantity. The New York State Energy Research and Development Authority issues competitive requests for proposal and, provided that qualified bidders respond, awards sufficient contracts to meet the goal. When generation—say, a wind or solar project—has been built, the state will purchase the RECs according to total production. This is a purely financial transaction. NYSERDA does not generate, purchase or distribute the power.

Consider offshore wind. While the wind is abundant and free, the cost of building a platform in the ocean, assembling and mounting a massive turbine, and running the needed cable to shore is prohibitive at current energy prices. The REC (an offshore renewable certificate or “OREC” in this case) pays the difference between the expected private payback and the cost. Depending on how the bidding is structured and the competitiveness of the market, the subsidy can be modest or quite large.

Each of the state’s utilities (“load serving entities” or “LSEs” in power jargon) is assigned a share of the state’s targeted renewable goal and is obligated to purchase from NYSERDA its share of renewables in the form of RECs.

The NYSERDA revenue budget for FY20-21 included $595 million in utility surcharges, $590 million in zero emission credits (paid by the utilities) and $46 million in RECs. The utilities, in turn, pass these charges on to ratepayers (you and me).

Blowing in the wind

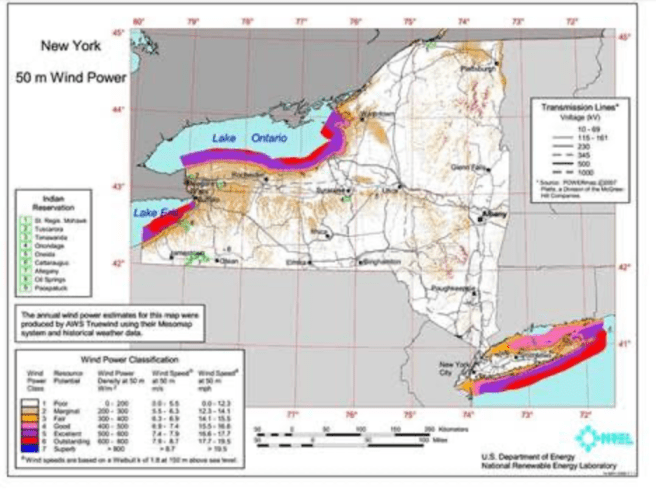

The National Renewable Energy Laboratory has mapped wind power potential for the nation. Peak power potential runs from the northern Great Plains through Texas.

Parts of New York offer significant wind power capacity, however, particularly offshore.

The installed capacity in New York has reached nearly 5,000 megawatt hours, a near doubling in only a decade. The state Department of Public Service reports that another 2,600 MW of projects are in the regulatory pipeline.

I can see for miles and miles

Offshore wind has a number of advantages over the terrestrial variety. Wind speeds are much higher and the wind blows with greater consistency. Opposition from homeowners and the cost of prime sites can make siting wind farms near major coastal cities nearly impossible. Dolphins don’t vote, however. Moreover, approval authority for offshore sites leapfrogs local government. A planned wind farm in the Atlantic is only 14 miles from Long Island’s Jones Beach.

The only offshore wind farm in operation in the U.S. currently is the small 30 MW Block Island Wind Farm off Rhode Island. Many others are well along the planning and permitting process, however. Just as New York’s plan mandates new offshore development, President Joe Biden has directed the Interior Department to double offshore wind production by 2030.

New York’s first offshore project is expected to be the 130 MW South Fork Wind Farm contracted by the Long Island Power Authority in 2017 and scheduled to begin operating in 2023.

NYSERDA’s first competitive bid for offshore wind (held in 2018) resulted in awards of Offshore RECs to Empire Wind 1 (816 MW) and Sunrise Wind (880 MW). They hope to begin operating in 2024.

“The Empire Wind 1 and Sunrise Wind projects have an average all-in development cost of $83.36 per megawatt hour (2018 dollars) with an expected average OREC cost of $25.14 per megawatt hour. The average bill impact for residential customers will be less than a dollar per month per customer – approximately $0.73. These prices are approximately 40 percent less than projected by NYSERDA’s 2018 analysis, signaling that offshore wind is an increasingly competitively priced renewable energy resource.”

The second solicitation in 2020 yielded an additional 2,500 MW, awarding ORECs to Empire Wind 2 and Beacon Wind. Developers have also expressed interest in fresh water sites. As seen in the map above, sections of the Lake Erie and Lake Ontario coasts offer significant wind power potential.

This little light of mine

Photovoltaic cells able to convert light into electricity were developed in 1954 at Bell Labs. While solar cells have powered low-power devices for decades, the efficiency of photovoltaic cells to provide utility-scale electricity is a recent phenomenon.

Utility-scale solar makes a small contribution to New York power needs today, but that is changing swiftly. Projects totaling another 6,400 MW of utility-scale proposals are in the regulatory pipeline. All solar sources contributed 0.4 percent of the state’s power in 2019. Wind’s share was 3.4 percent.

The state’s NY Sun program has also provided incentives for the development of 145,336 small-scale “community” solar projects, generating an additional 2,803 MW of solar power.

Show me the money

Powerful incentives supporting the expansion of alternative generation are intended to offset the cost of climate change, help new forms of generation achieve cost-effective scale, and support ongoing technical improvements.

Eventually, alternative sources of power like wind and solar should be competitive without a subsidy. How do alternative fuels stack up?

Comparing the cost of alternative sources of electric generation is complicated. Wind and solar are expensive to build but comparatively costless to run. A natural gas plant, on the other hand, is cheaper to build (for equivalent capacity) but requires fuel to generate power. The U.S. Energy Information Agency develops forecasts of the “levelized cost of energy” for different types of generation. Forecast uncertainty is considerable:

■ Will interest rates remain low over the planning horizon? Low interest rates favor projects with high upfront costs and low operating costs, such as wind and solar.

■ What is the anticipated price path for natural gas? The shale gas revolution caught many by surprise—few anticipated that natural gas prices would fall so dramatically as total production in the United States nearly doubled between 2005 and 2019.

■ How will economic conditions, public opinion and public policy influence the demand for green power, thus the subsidies offered for new generation?

The financial return to renewables varies dramatically by location. The average wind speed and hours of sunlight affect the viability of wind and solar power by region. The power also must have someplace to go—a major wind or solar project that straddles a transmission line is less expensive to bring online than one that is relatively isolated. The strong and sustained winds of the Texas Panhandle could be harnessed only by building new transmission lines.

The U.S. Energy Information Administration reports estimates of the “average” cost of a range of technologies. A standalone solar installation is the lowest-cost technology considered, still under the cost of natural gas “combined cycle” without the subsidy. Geothermal, while not discussed here, is also competitive.

Offshore wind, by contrast, is far more expensive than most of the other options. Proponents believe that costs will fall as construction techniques improve. While early adopters will pay more, later projects will benefit.

As noted above, NYSERDA’s recent bidding process attracted prices that were lower than the authority anticipated and, at $83 per MW, lower than the $115 in the adjacent EIA table.

Daddy, are we there yet?

R.Dervisoglu, via Wikimedia Commons

The fuel cell is not the new kid on the block. Invented in 1839, it generates electricity through a chemical reaction that divides hydrogen molecules into protons and electrons. The freed electrons become an electric current while the protons combine with oxygen to produce water (you might remember H2O from grade school science class). Water’s a much better “tailpipe emission” than carbon dioxide.

Fuel cells have been used in niche applications for generations, including by NASA in the Gemini and Apollo space missions and the space shuttle. Interest in fuel cells for automotive applications prompted General Motors to begin investing in the technology, leading to the 1998 establishment of an R&D centerin Honeoye Falls. Delphi, a GM spinout, had also established a research facility in Rochester. Both firms collaborated with researchers at the University of Rochester and Rochester Institute of Technology.

GM closed the Honeoye Falls R&D center and moved the operation to Michigan in 2013, prompting a group of former GM researchers to establish American Fuel Cell. Led by Daniel O’Connell, AFC established a research partnership with RIT and built a manufacturing facility at Eastman Business Park in 2016. AFC was acquired by Plug Power in 2018.

Plug Power and New York recently announced an expansion of the Rochester facility. The company predicts that the initiative will add 375 jobs to the region by mid-year. O’Connell leads the initiative for Plug Power.

In another development, Singapore-based Horizon Fuel Cell Technologies spun off its Heavy Vehicle Business Unit to form a new business, Hyzon Motors Inc. In 2020, Hyzon established its headquarters in Honeoye Falls at the former General Motors facility. A nearly $8 million expansion, assisted by Empire State Development, is in process. The company has also disclosed an agreement with Decarbonization Plus Acquisition Corp., a “blank check” public company (NASDAQ: DCRB), that will result in Hyzon becoming a publicly traded company currently valued at $2.7 billion.

Powered by a fuel cell, a car can have all the advantages of electric propulsion without the range limitation imposed on battery-powered electrics. A fuel-cell-powered vehicle still needs to refill its hydrogen tanks periodically, but the process is more like refilling a gas tank than the hours-long recharging needed for battery-powered electrics.

Hydrogen-powered mobility confronts challenges: Not only is the distribution system for hydrogen almost nonexistent, but hydrogen is expensive. While abundant in the environment, it nearly always appears as part of another compound like water or methane and needs to be separated into pure hydrogen to be used in a fuel cell vehicle. In another “catch-22” of alternative energy, that process takes power.

The need for more affordable and more “green” hydrogen prompted another Plug Power initiative in the region. The company plans to build a hydrogen facility at the Western New York Science, Technology and Advanced Manufacturing Park in the town of Alabama in Genesee County. Plug Power expects to create 68 jobs at the new facility, which will produce 45 tons of hydrogen daily. By locating at STAMP, Plug Power will have access to low-cost, renewable power generated by the hydroelectric dam at Niagara Falls.

It’s not easy being green

A study released in 2020 reviewed the track records of established climate models and concluded that their forecasts have been reasonably accurate. Predicting a “central tendency” for average temperature change is only part of the challenge, however. Given the complexity of climate systems, the effects of temperature rise are far more difficult to forecast than the rise itself.

Will the push to renewables be sufficient to forestall the most serious effects of temperature rise? The National Academies of Sciences, Engineering and Medicine just released a report arguing for a major investment in geoengineering titled “Reflecting Sunlight: Recommendations for Solar Geoengineering Research and Research Guidance.” While anathema to the core of the environmental movement, the pace of global change has persuaded many scientists that geoengineering is worth a serious look.

As noted at the top of this post, climate change is a global problem. As the second-highest contributor of GHG emissions, the U.S. has a responsibility to do its part and more. Harnessing the power of our scientific prowess to the challenge is necessary and timely.

Renewable power is part of the solution. Steady advances in efficiency, along with public policies nudging markets to support new forms of generation, will slow greenhouse gas emissions. Continued technological and policy innovation can help. Economists’ long-preferred solution, the carbon tax, would accelerate all forms of carbon reduction. The New York Independent System Operator, which runs the state’s power grid, has urged passage of such a tax and a bill has been introduced in the state Senate and has been adopted in Canada. The “tail risks” of climate change recommend that all solutions be on the table.

Kent Gardner is Rochester Beacon opinion editor and chief economist, Center for Governmental Research.